Tax Resource Center

Tax season is upon us. We’re here to help you prepare.

For small businesses in the United States, filing taxes requires more than just getting your hands on tax forms in a timely manner. We know firsthand how confusing tax forms can be, so we’ve created numerous helpful resources to answer your most common tax season questions. We also manufacture our own line of popular blank forms from 1099s to W2s with fast and free shipping, as well as convenient e-filing services. Best of all, our locally based customer service team is available to answer your phone calls and emails during business hours throughout January and beyond. Read on to get started!

Tax FAQs

We sincerely apologize for any missing forms. Please reach out to our customer service team and be sure to include your order number and which forms were missing. Extra forms or a complete replacement will be shipped as soon as possible, at no cost to you.

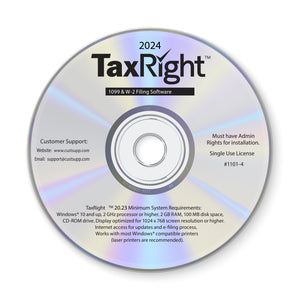

When launching the software, you may be prompted to run a software update. This software update must be installed before the provided product key will work. Please try closing and reopening the software and allow the program to run any software updates. After the software has been updated, try the product key again. If you continue to have issues, please contact us here.

Printing issues are frequently caused by using the incorrect type of tax forms per your tax software. Please reference the following blog posts for more detailed assistance on printing from QuickBooks or TaxRight (formerly called TFP).

How to Print 1099 Forms in QuickBooks

How to Print W2 Forms in QuickBooks

How to Use TaxRight Software (Formerly Known as TFP)

For assistance printing from other software programs, we recommend reaching out to the software manufacturer directly to ensure you are using the correct forms and for help adjusting the print alignment.

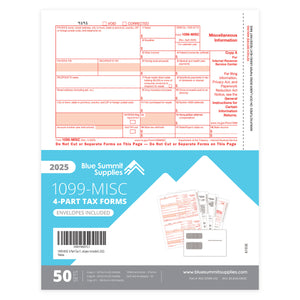

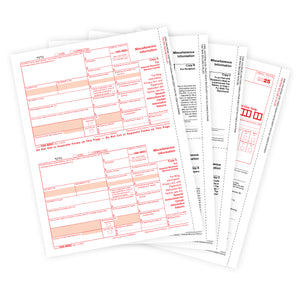

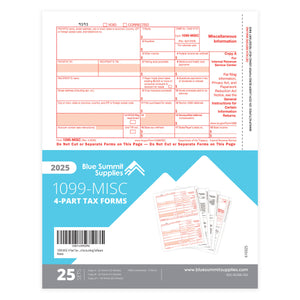

In general, our forms are not sold with tax form software included, nor do we offer a fillable PDF template. You may purchase TaxRight software disc here, or as part of a bundle with various types of tax forms here.

Please note: Although now sold under a different name, TaxRight software is the same thing as TFP software. The manufacturer of TFP software rebranded the software for 2021, and it is now called TaxRight. Former TFP users will be able to seamlessly import TFP records into TaxRight software as they have done in previous years.

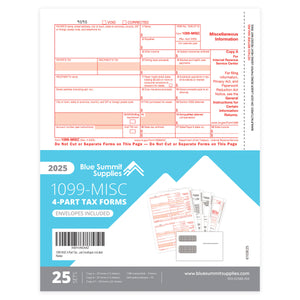

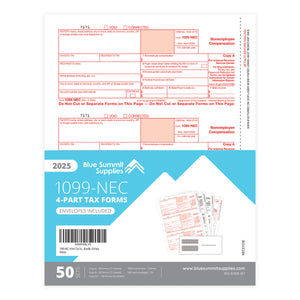

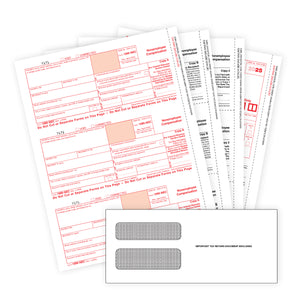

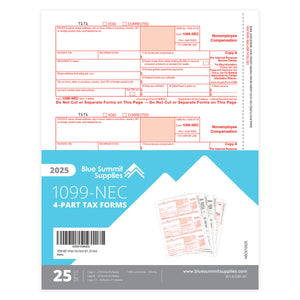

Starting in the 2020 tax year, nonemployee compensation reporting was moved to a separate form called Form 1099-NEC. Businesses who are used to reporting nonemployee compensation in Box 7 on Form 1099-MISC must now use the 1099-NEC form for independent contractors or freelancers. Furthermore, the 1099-NEC form was changed from 2 forms per page to 3 forms per page in the 2021 tax season. For more information, we have written this helpful blog post about the new 1099-NEC form.

Tax Form Solution

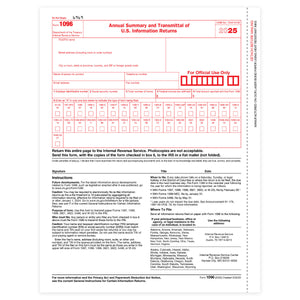

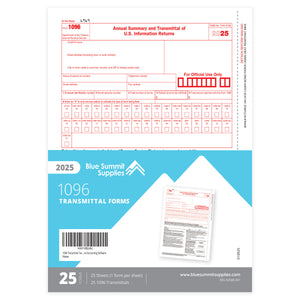

1099 Forms

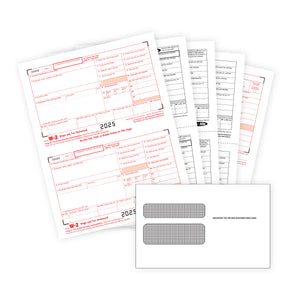

W2 & Transmittal Forms

Tax Software

Contact Customer Service

Need help? Fill out the contact form below and we'll get back to you as soon as possible.