You’re all set to complete your taxes, and you’re just about to finish filling out Form 1099-MISC when you notice that Box 7 isn’t there anymore. Well, it’s there, but it has nothing to do with nonemployee compensation. You may be asking yourself, does the IRS not require this information anymore? Obviously, that can’t be true. So… where’d Box 7 go, and where do you report nonemployee compensation? Starting in the 2020 tax year, nonemployee compensation reporting was moved to a separate form—Form 1099-NEC.

This change sparks a number of questions for business owners who are used to reporting nonemployee compensation in Box 7 on Form 1099-MISC. (One of the main questions being: why the heck do I need to fill out YET ANOTHER FORM?)

In this post, we’ll cover everything you need to know about the change so that you’re prepared once tax season rolls around.

Below you’ll find:

- Box 7 Moved From 1099-MISC Form

- Form 1099-NEC 2020 Reissue

- 1099-NEC Tax Form vs. 1099-MISC Tax Form

- What is 1099-NEC and When is it Used

- Defining Nonemployee Compensation

- Reporting Nonemployee Compensation

- Form 1099-MISC 2020 Changes

- Download Links for Form 1099-NEC

Beginning with tax year 2020, nonemployee compensation will no longer be reported in Box 7 of the 1099-MISC form. Instead, all nonemployee compensation must now be reported on a separate Form 1099-NEC. If you pay an independent contractor nonemployee compensation, you must separate nonemployee compensation payments from all of your other Form 1099-MISC payments.

Beginning with tax year 2020, nonemployee compensation will no longer be reported in Box 7 of the 1099-MISC form. Instead, all nonemployee compensation must now be reported on a separate Form 1099-NEC. If you pay an independent contractor nonemployee compensation, you must separate nonemployee compensation payments from all of your other Form 1099-MISC payments.

Box 7 Moved From 1099-MISC Form

Previously, businesses reported all nonemployee compensation on the 1099-MISC form. Nonemployee compensation was reported on Box 7 of the form, which is now used to report if a payer made direct sales of $5,000 or more.

This change is for the 2020 tax year and beyond, which means you do not need to use Form 1099-NEC if you are filing for the 2019 tax year or prior. You will use a Form 1099-NEC to report nonemployee compensation you paid during the 2020 tax year when you report in 2021 or beyond.

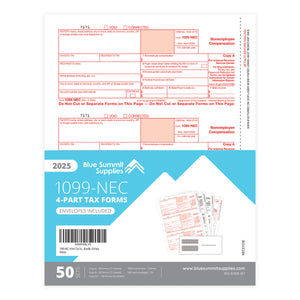

Form 1099-NEC 2020 Reissue

The nonemployee compensation Form 1099-NEC isn’t new—it’s actually an old form that has not been used since 1982. The IRS brought out of retirement starting in 2020 to split nonemployee compensation up from miscellaneous income.

1099-NEC Tax Form vs. 1099-MISC Tax Form

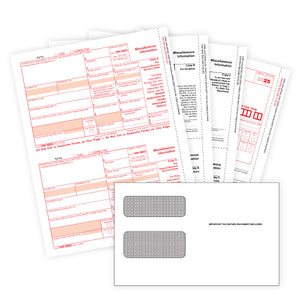

The 1099-NEC is a different form than the 1099-MISC. Form 1099-NEC reports nonemployee compensation, whereas Form 1099-MISC reports other miscellaneous income.

Starting in 2020, businesses need to report nonemployee compensation on a separate Form 1099-NEC in addition to any other miscellaneous income reported on Form 1099-MISC.

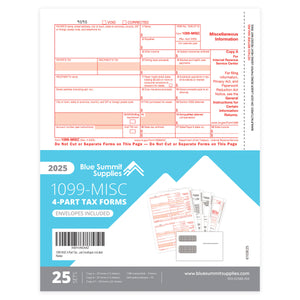

In 2021, the 1099-NEC form changed again from 2 forms per page to 3 forms per page. Because of the change in form size, a new envelope will be required for mailing recipient copies that fits the smaller size 2021 1099-NEC forms.

What is 1099-NEC and When is it Used

Form 1099-NEC will replace Form 1099-MISC for reporting nonemployee compensation beginning with the 2020 tax year. This means that for the 2022 tax season, businesses will need to file Form 1099-NEC to report nonemployee compensation paid during the 2021 tax year.

You are not required to use Form 1099-NEC in the 2020 tax season to report nonemployee compensation payments your business made during 2019.

The IRS says you must file Form 1099-NEC, Nonemployee Compensation (NEC), for each person in the course of your business to whom you have paid the following during the year:

At least $600 in any of the following:

- Services performed by someone who is not your employee (including parts and materials) (box 1)

- Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish (box 1)

- Payments to an attorney (box 1)

You must also file Form 1099-NEC for each person from whom you have withheld any federal income tax (report in box 4) under the backup withholding rules regardless of the amount of the payment.

Defining Nonemployee Compensation

Among the different types of employee compensation is nonemployee compensation. Nonemployee compensation refers to payments made to people who are not your employees, but who have still provided a service to your business, such as a contractor.

Nonemployee compensation can include payments made toward:

- Independent contractors

- Independent consultants

- Independent freelancers

- Other independent workers

- Any parts or materials used to perform those services

- Witness fees

- Prizes

- Awards for services

- Nonemployee salesperson commissions

- Other types of commissions

- Professional service fees, including payments made to accountants, architects, attorneys, etc.

View the IRS’s Form 1099-MISC and 1099-NEC guidelines for a complete list of nonemployee compensation payments your business may need to report. If you are uncertain, contact your CPA who can help you make decisions based on your exact circumstances.

Identifying Employees vs. Contractors

Businesses need to properly identify whether or not they are paying employees or contractors when filing taxes each year since the designation directly affects the rate of tax to be paid and the forms required. It can be difficult to distinguish between employees and nonemployees, especially as a relationship between an individual and a business grows.

The United States Department of Labor says the “determination of the relation cannot be based on isolated factors or upon a single characteristic, but depends upon the circumstances of the whole activity.” There are six characteristics to consider when distinguishing between an employee and an independent contractor:

- Does the worker play an integral role in the business?

- How permanent is the relationship?

- What is the worker’s investment in the business? Do they use their own resources, tools, or equipment?

- How much control does the worker have? Who makes decisions about hours, quality control, and pay rate? Does the worker work for other companies?

- What opportunities does the worker have for profit and loss? (Ex. investments or profits based on job performance.)

- What level of skill and initiative is required to perform the job? Does the worker advertise independently? Does the worker have a separate business site?

Employees and independent contractors pay different tax rates, so it is critical that businesses differentiate between the two. Payments made to independent contractors are a type of nonemployee compensation that you’ll need to report in your tax filings (Form 1099-NEC beginning in the 2020 tax year).

Reporting Nonemployee Compensation

All qualifying types of nonemployee compensation must be reported to the IRS on the appropriate forms.

In the past, you were required to report nonemployee compensation within Form 1099-MISC. Beginning with the 2020 tax year, you will now need to use Form 1099-NEC to report nonemployee compensation.

Form 1099-NEC Exceptions

There are exceptions to what needs to be reported on Form 1099-NEC, although they may be taxable to the recipient.

The IRS says payments for which a Form 1099-NEC is not required include the following:

- Generally, payments to a corporation

- Payments for merchandise, telegrams, telephone, freight, storage, and similar items

- Payments of rent to real estate agents or property managers. (The real estate agent or property manager must use Form 1099-MISC to report rent paid to the property owner.)

- Wages paid to employees

- Military differential wage payments made to employees while they are on active duty

- Business travel allowances paid to employees

- Cost of current life insurance protection

- Payments to a tax-exempt organization, including tax-exempt trusts

- Payments made to or for homeowners from the HFA Hardest Hit Fund or similar state program

- Compensation for injuries or sickness by the Department of Justice as a public safety officer disability or survivor's benefit, or under a state program that provides benefits for surviving dependents of a public safety officer who has died as the direct and proximate result of a personal injury sustained in the line of duty

- Compensation for wrongful incarceration for any criminal offense for which there was a conviction under federal or state law

Form 1099-MISC 2020 Changes

Since reissuing the Form 1099-NEC to handle all nonemployee compensation reporting, the IRS made changes to Form 1099-MISC. The changes include how and where you report income, as well as changes to the box numbers. According to the IRS, the changes to Form 1099-MISC are as follows:

- Payer made direct sales of $5,000 or more (checkbox) in box 7.

- Crop insurance proceeds are reported in box 9.

- Gross proceeds to an attorney are reported in box 10.

- Section 409A deferrals are reported in box 12.

- Nonqualified deferred compensation income is reported in box 14.

- Boxes 15, 16, and 17 report state taxes withheld, state identification number, and amount of income earned in the state, respectively.

Download Links For Form 1099-NEC

You can download a copy of Form 1099-NEC on the IRS website:

💡 For a more extensive look at Form 1099-NEC, including deadlines, how to fill out Form 1099-NEC, and how to file Form 1099-NEC, read our article: What is Form 1099-NEC for Nonemployee Compensation?

Keep in mind that if you’re unclear on any of your obligations and make a mistake during the filing process, you could suffer penalties that otherwise could be avoided. If you have more questions about your business’s filing obligations surrounding Form 1099-NEC, ask your CPA or a qualified tax professional to guide you through the process.