Despite the economic challenges posed by the pandemic, the number of U.S. business applications has shot up in the last quarter, with more than 1.5 million applications for Employer Identification Numbers (EINs) tallied by the Census Bureau’s Q3 report. New businesses are being formed at the fastest pace in more than a decade, after tens of millions of Americans lost their jobs in the spring.

If you‘re one of those thinking of putting up your own company, you should start with getting an EIN. To help you get started, we'll take you through the basics of what exactly an EIN is, what it's for, and how to get one.

What is an EIN?

An EIN is a number assigned by the Internal Revenue Service (IRS) to identify a business for tax purposes. It’s basically a taxpayer ID for a business, used for bank account applications, income tax forms, and employment tax reports and payments.

Does Your Business Need an EIN?

Your business will need an EIN if you have employees, or if you file certain kinds of taxes. It will also be required if your business is taxed as a corporation or a partnership.

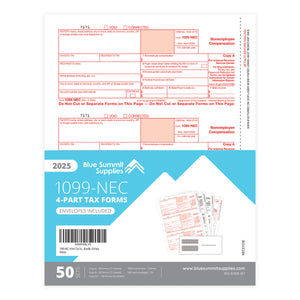

You might also need an EIN for filing tax returns for employment taxes, excise taxes, and alcohol, tobacco, and firearms sales. When reporting non-employee income paid to independent contractors, you’re required to submit Form 1096 to the IRS, in which you’re also asked for your EIN.

Sometimes, though, even single-member limited liability companies (LLC) might need an EIN. Despite its name, an Employer ID Number can help even businesses that don’t hire employees, because it acts like a Social Security number for your LLC and is required for when getting a business checking account. That’s why ZenBusiness’s guide to setting up an LLC recommends applying for an EIN as the final step in formally establishing your business. This registers you with the federal government and lets you fully enjoy the benefits of setting up an LLC and it being a registered tax-paying entity. One of the best things about an LLC is that it allows the business to choose how it will be taxed, thus giving your business the most options with an EIN.

Before You Apply - Designate Your Responsible Party

In the EIN application, you need to include the name and taxpayer ID of the one controlling, managing, or directing your business and the disposition of its funds and assets. This is called the responsible party, and it must be a person, not a business. If your business has more than one person with that role, just appoint one for the application.

How Do I Apply for an Employer ID Number?

You can apply online using the IRS EIN Assistant process, or call the IRS Business and Specialty tax line at 800-829-4933. You can also fax your completed and signed SS-4 Form to the IRS. Whether online, by fax, or by U.S. mail, you can only submit one Form SS-4 per day.

When Do You Need a New EIN?

In The Balance Small Business's guide to changing business types, part of the checklist is getting a new EIN as it may be required, depending on your new business structure.

If your business is a subsidiary of a corporation, or creates a new corporation after a statutory merger, a new EIN will also be needed. Other cases requiring a new EIN include a change in business name or address, or ending a partnership business and beginning a new one.

Sole proprietors must get a new EIN if they are subject to a bankruptcy proceeding. But when corporations or partnerships declare bankruptcy, they won’t be needing a new EIN.

Overall, your EIN is like your tax or legal fingerprint. It can’t be recycled. It won't expire. But when you're finished with it, it's gone forever.

For more informative articles about office supplies, subscribe to our email newsletter!

For more informative articles about office supplies, subscribe to our email newsletter!

Never fear, you won't begin receiving daily sales emails that belong in a spam folder. Instead, we promise a fun weekly roundup of our latest blog posts and great finds from across the web. And if you lose interest, it's always easy to unsubscribe with a single click.