Form W-2, officially known as the Wage and Tax Statement, is an Internal Revenue Service (IRS) tax form used to report wage and salary information for employees, plus the amount of federal, state, and other taxes withheld from your paycheck.

Employers have a crucial role here, where they must:

- complete a Form W-2 for each employee who receives a salary, wage, or any other compensation from them, and

-

mail out the Form W-2 to employees on or before January 31

The January 31st deadline means you have a maximum of 31 days to ensure the forms are correct, print them, and give them to your employees. Luckily, QuickBooks can make this important task really easy and fast.

To help you get this process right, we’ve listed detailed W2 printing instructions below. We’ve also included a W2 Printing FAQ with quick answers to common questions at the bottom of this guide, just in case you get stuck along the way.

Quick Links

- How to Print W2 Forms in QuickBooks Online

- How to Print W2 Forms in QuickBooks Desktop

- Common FAQs: How to Print W-2 Forms in QuickBooks

How to print W2 Forms in QuickBooks Online

Printing Requirements

Before we discuss the steps, you should verify you know the W-2 form printing requirements.

- Print the employee copies on either blank 3-part perforated paper or blank 4-part perforated paper

- Use black ink (this is an IRS requirement), and if possible, in 12-point Courier font

- Have an active QuickBooks Online payment subscription

Note: QuickBooks Online isn’t compatible with PDF W-2 forms downloaded from the IRS website. Also, it no longer supports 2-part perforated preprinted W-2 forms.

Step 1: Set Your Form W-2 Printing Preferences

You have to tell QuickBooks which type of paper you’ll print your form on. To do this, follow the steps below:

- Click Settings followed by Payroll Settings.

- From W-2 print preference, select

- Choose the type of paper you want to use to print the forms.

-

Select

Step 2: View and Print Your W-2 Forms

This is where you'll print the actual forms. Here's how to go about this:

- Select Taxes, followed by Payroll Tax.

- Select Filings and then Annual Forms.

- You can print both employer and employee copies of your W-2s and W-3. You can choose from the following:

- Employer Copies: Form W-2 (W-2, Copies A & D)

- Transmittal of Wage and Tax Statements (W-3)

- Employee Copies: Form W-2 (W-2, Copies B, C & 2)

- You may see a prompt on your screen asking if you or your employees contributed to a retirement plan outside of QuickBooks Online. Select yes or no as applicable.

- Follow Steps 1-3 to get back to your W-2 or W-3 form.

- From the dropdown, choose the applicable filing period (year).

- Select View to open Adobe Reader in a new window.

- On the Reader toolbar, click on the print icon. Select Print

How to print W2 Forms in QuickBooks Desktop

W-2 and W-3 forms aren’t compatible with QuickBooks Desktop Payroll Basic. You have to upgrade to either QuickBooks Desktop Payroll Enhanced or QuickBooks Desktop Payroll Standard.

Printing Requirements

Keep the following W-2 form printing requirements in mind before you start printing:

- Print the employee copies on either blank 3-part perforated paper or pre-printed 4-part perforated paper

- Use black ink (this is an IRS requirement), and if possible, in 12-point Courier font

- Have an active QuickBooks Online payment subscription

Note: If you’re using QuickBooks Desktop Assisted Payroll, you can print your W-2s on blank 4-part perforated paper or plain paper. Also, QuickBooks Desktop isn’t compatible with PDF W-2 forms downloaded from the IRS website.

Step 1: Open Your W-2 in QuickBooks Desktop

- Select Employees, followed by Payroll Tax Forms and W-2s and Process Payroll Forms from the top menu.

- From the File Forms tab, scroll down and click on the Annual Form W-2/W-3 - Wage and Tax Statement/ Transmittal If you can’t find the forms in the list, it’s likely due to one of the following reasons:

- The form may be below the previewed list. Simply scroll down to find the form.

- The form may be inactive. To activate your W-2 form, click the Forms dropdown arrow and select Make a New Form Active. Next, click on the State dropdown arrow and select Federal. Choose the W-2 form and click Add Form.

- Once you have the W-2 form, in the Process W-2s for options:

- Select All Employees if you want to print W-2s for all your employees at once.

- Select Employee's Last Name (choose from and to) to print by batch.

-

Next, in the Select Filing Period section, enter the year of the form you are printing and click OK in the Year

QuickBooks Desktop only stores one version of the tax form. If you've already received the 2021 version of the form, but need to print W-2 forms for 2020, you can use the newer version of the form. Be sure to check with the Social Security Administration or your tax advisor for additional instructions before proceeding.

- If you choose to print the forms for 2020 on blank paper, they will include the year "2020" because the year is part of the government-approved form.

- If you choose to print the forms for 2020 on a pre-printed form, QuickBooks Desktop might not print the information in the correct locations. QuickBooks Desktop will print the form details aligned for 2021.

- In the Select Employees for Form W2/W3 window, select the employees for whom you're printing. To select all employees displayed, click Mark All.

If you haven't reviewed all W-2 forms (QuickBooks will usually flag this by displaying missing checkmarks in the Reviewed column), click Review/Edit.

- After reviewing, click Submit Form to continue printing.

-

Select Print/E-file. This will open the Print W-2 and W-3 Forms window.

Step 2: Select the W-2s You Want to Print and the Paper You’ll Use to Print Them

In the Print/E-file window, your W-2s will be listed by the recipient (for instance, 'For employer,' and 'For government'). QuickBooks Desktop has a few nuances to keep in mind, such as:

- You can only print one form at a time

- Printing options in the For Employees section will vary, depending on the type of paper you’re using.

- The Print W2 and W3 Forms window will stay open until you close it. As such, you can go back and print one form after another (and another) without having to close and re-open the window.

Here's how to go about printing the W-2 forms:

- In the Select Paper section, choose either Blank/Perforated Paper and Preprinted Forms: May require alignment.

- Next, choose who you're printing W-2s for:

○ For employees

If you're using Perforated Paper:

- 3 per page: copies B, 2, C

- 4 per page: copies B, 2, 2, C

- Employee filing instructions: Required if not already printed on paper.

If you're using Preprinted Forms:

- W-2 – Copy B: for employee’s federal tax return, 2 per page (1 per page if only 1 employee).

- W-2 – Copy 2: for your State or Local Tax Department, 2 per page (1 per page if only 1 employee).

- W-2 – Copy C: for employee records, 2 per page (1 per page if only 1 employee).

- Employee filing instructions: Required if not already printed on paper.

○ For employer

- W-2 – Copy D: for your records, 2 per page (1 per page if only 1 employee).

- Employer filing instructions: for W-2 and W-3 form.

○ For government

- W-2 — Copy A: for the Social Security Administration, 2 per page (1 per page if only 1 employee).

Note: If you're filing Forms W-2 and W-3 electronically with the Social Security Administration, do not mail Copy A.

-

W-2 — Copy 1: for your State or Local Tax Department, 2 per page (1 per page if only 1 employee).

Step 3: Export Your W-2 Forms to Your PDF Reader to Print Them

- If you're using blank perforated W-2s, you can print your forms right away. But if you're using preprinted W-2s, you should do a print test to check alignment. If your forms aren’t lining up, follow these instructions to adjust alignment before proceeding.

- Click Print PDF. This exports your selected W-2s to your computer’s PDF Reader.

-

To print your W-2s from your computer’s PDF reader, select File followed by Follow the displayed prompts to finish the steps.

Common FAQs: How to Print W-2 Forms in QuickBooks

Quick Links

- 1) What’s the difference between Form W-2 and Form W-3?

- 2) Which one do I need: 4-part W-2 or 6-part W-2? What should I do with it?

- 3) Where do you send the different "parts" of W-2s?

- 4) Can I print my W-2s on the IRS’s free PDF W-2 forms?

- 5) What type of paper should I use to print my W-2s?

- 6) Can I mail my W-2 forms to the IRS?

- 7) Do I need a special envelope to mail W-2s to employees?

- 8) Can I reprint a W-2 form if my employee lost or didn’t get the original W-2?

- 9) Why can’t I see my W-2s in QuickBooks?

- 10) Can I still access my archived forms if I no longer have an active QuickBooks Payroll subscription?

1) What’s the difference between Form W-2 and Form W-3?

Form W-2 reports employee wages and salaries to federal, state, and local agencies, along with a copy for the employee.

On the other hand, Form W-3, also known as the W-3 Transmittal Summary Form, is required when you file W-2s by mail. W-3s add up all the information on your individual W-2 forms into a total for the Social Security Administration (SSA).

Buy W-3 forms online from Blue Summit Supplies. These forms comply with IRS and QuickBooks printing requirements.

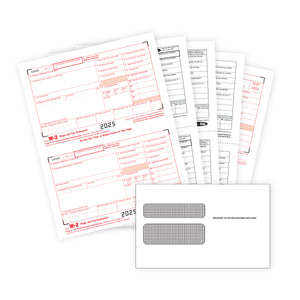

2) Which one do I need: 4-part W-2 or 6-part W-2? What should I do with it?

Your state’s filing requirements will determine whether you need to arrange a 4-part or a 6-part W-2. You have to be careful here as filing incorrectly can result in penalties. Be sure to check with your tax advisor to confirm how many “parts” your W-2 forms will need to stay on the safe side.

Here’s what each W-2 contains:

4-Part W-2s

PART 1: Copy A

PART 2: Copy 1

PART 3: Copy B

PART 4: Copy C

6-Part W-2s

PART 1: Copy A

PART 2: Copy 1

PART 3: Copy B

PART 4: Copy C

PART 5: Copy 2

PART 6: Copy D

information in the above table is accurate for the 2021 tax season

3) Where do you send the different "parts" of W-2s?

Here’s where to send each part of the W-2:

4-Part W-2s

Copy A goes to the Social Security Administration

Copy 1 is for the city, state, or locality

Copy B is for filing with the employee's federal tax return

Copy C is for the employee's records

6-Part W-2s

Copy A goes to the Social Security Administration

Copy 1 is for the city, state, or locality

Copy B is for filing with the employee's federal tax return

Copy C is for the employee's records

Copy 2 is another copy for a city, state, or locality

Copy D is for the employer's records

4) Can I print my W-2s on the IRS’s free PDF W-2 forms?

No. You cannot use the IRS’s free PDF W-2s to print with QuickBooks (or any other type of accounting software for that matter).

Here's what the IRS's W-2 form filing instructions say: “Do not send the SSA Forms W-2 and W-3 that you have printed from IRS.gov. The SSA is unable to process these forms. Instead, you can create and submit them online."

5) What type of paper should I use to print my W-2s?

QuickBooks Online

- For QuickBooks Online, either blank 3-part perforated paper or blank 4-part perforated paper.

- For QuickBooks Desktop, either blank 3-part perforated paper or pre-printed 4-part perforated paper.

-

For Assisted Payroll, either blank 4-part perforated paper or plain paper.

6) Can I mail my W-2 forms to the IRS?

Yes. The IRS allows businesses with less than 250 W-2s to file W-2s via mail. Send the forms by U.S. Postal Service to the Social Security Administration at Data Operations Center, Wilkes-Barre, PA 18769-0001.

If you need to file 250 W-2 forms or more, you must file them electronically. Remember, employees must consent to receive their W-2s electronically. The IRS requires employee consent before you deliver W-2s electronically.

7) Do I need a special envelope to mail W-2s to employees?

No, but you’ll save time and avoid mailing errors if you use custom W-2 envelopes.

These double-window envelopes display the employer and employee addresses once your W-2 form is inserted into the envelope.

8) Can I reprint a W-2 form if my employee lost or didn’t get the original W-2?

Yes, you can. Just write REISSUED STATEMENT on the top and include a copy of the W-2 instructions.

9) Why can’t I see my W-2s in QuickBooks?

W-2 forms become available in QuickBooks from January 1 onwards. Once you’ve finished running payroll for the year, you can log in, access your W-2s, and print them out.

If you can’t see W-2s in your QuickBooks account, it could have something to do with your QuickBooks subscription.

- To view and print W-2s in QuickBooks Desktop Payroll, you have to be subscribed to the Enhanced Service or Standard Service.

-

If you're using the QuickBooks Payroll Basic Service, W-2 forms won't be available in QuickBooks Desktop. You can create a payroll summary report to get the data you need to complete the form manually.

If this isn’t the issue, the quickest way to troubleshoot this is to contact QuickBooks customer support.

10) Can I still access my archived forms if I no longer have an active QuickBooks Payroll subscription?

Yes, you can access an archived form even if your payroll subscription has expired.

- Go to the C:\Users\Public\Documents\Intuit\QuickBooks\Sample Company Files\QuickBooks 20xx\(Company Name) Tax Form History.

- Select the folder of the archived form you need. All folder names will have W-2, 941, and so on in the title so it's easier for you to identify the form you want.

For more informative articles about office supplies, subscribe to our email newsletter!

For more informative articles about office supplies, subscribe to our email newsletter!

Never fear, you won't begin receiving daily sales emails that belong in a spam folder. Instead, we promise a fun weekly roundup of our latest blog posts and great finds from across the web. And if you lose interest, it's always easy to unsubscribe with a single click.