If you’ve paid an independent contractor to do work for your business, you will likely need to file Form 1096. Yes, you heard correctly. There’s yet another tax form. In this post, we’ll explain when you need to fill out 1096 forms, how to do it, as well as how to reduce the number of forms you need by filing electronically.

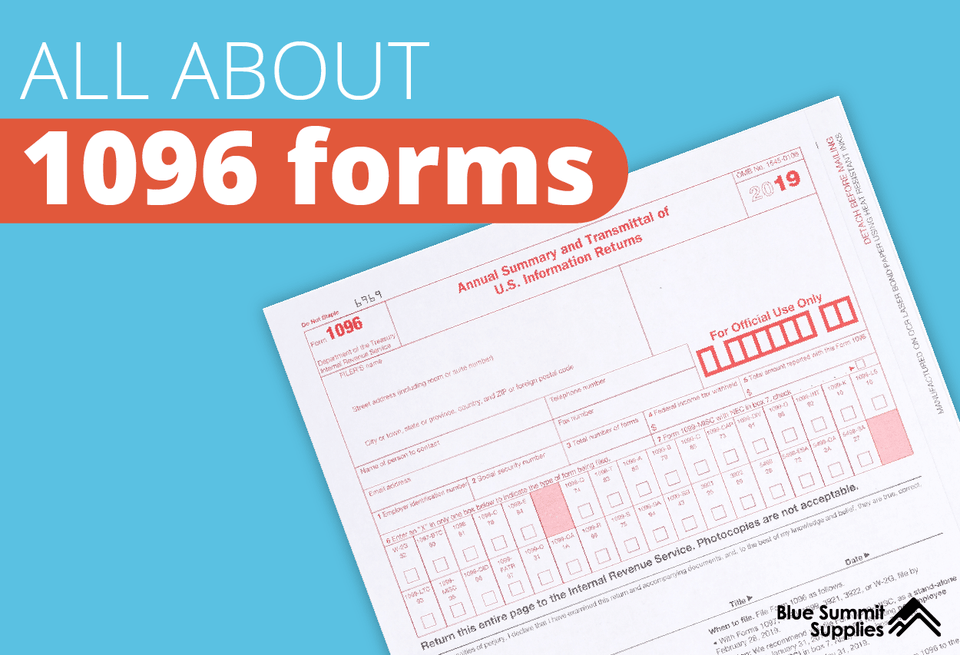

What is a 1096 Form?

Form 1096 is essentially a packing slip that lets the IRS know which forms you are mailing to report non-employee income.

The official title for Form 1096 is the Annual Summary and Transmittal of U.S. Information Returns. It’s a summary and transmittal form for some types of paper information returns. Think of it as a table of contents that tells the IRS which forms you have included and how many.

You need to file a Form 1096 if you are filing paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G. If you’re a small business, your main concern is probably filing 1099s for the independent contractors you have paid over $600 to during the specified financial year.

While each of these forms contains specific information about each transaction between you and the contractor, Form 1096 provides an overview of the type of form you’re filing. If you are filing seven 1097s, that total will be included on Form 1096.

How to Fill Out 1096 Forms

Group the forms by their form number and transmit each group with a separate Form 1096. The IRS provides this example: if you must file both Forms 1098 and 1099-A, complete one Form 1096 to transmit your Forms 1098 and another Form 1096 to transmit your Forms 1099-A.

Essentially, you’ll need to fill out a separate Form 1096 for each type of form you’re submitting. Keep in mind that the IRS sees all 16 versions of Form 1099 as separate forms. Even if you’re only submitting a single 1099-MISC and a single 1099-INT, you’ll need a separate Form 1096 for each of them.

The IRS instructions for completing Form 1096 are as follows. You’ll also find these instructions for how to fill out Form 1096 on the form itself.

| How to Fill Out 1096 Forms | ||

| Box 1 or 2 | Enter your TIN in either box 1 or 2, not both. Individuals not in a trade or business must enter their social security number (SSN) in box 2. Sole proprietors and all others must enter their employer identification number (EIN) in box 1. However, sole proprietors who do not have an EIN must enter their SSN in box 2. Use the same EIN or SSN on Form 1096 that you use on Form 1097, 1098, 1099, 3921, 3922, 5498, or W-2G. | |

| Box 3 | Enter the number of forms you are transmitting with this Form 1096. Do not include blank or voided forms or the Form 1096 in your total. Enter the number of correctly completed forms, not the number of pages, being transmitted. For example, if you send one page of three-to-a-page Forms 1098-E with a Form 1096 and you have correctly completed two Forms 1098-E on that page, enter “2” in box 3 of Form 1096. | |

| Box 4 | Enter the total federal income tax withheld shown on the forms being transmitted with this Form 1096. | |

| Box 5 | No entry is required if you are filing Form 1098-T, 1099-A, or 1099-G. For all other forms in the listing that follows, enter the total of the amounts from the specific boxes identified for each form. | |

| Box 6 | Simply put an ‘X’ in the box that signifies which type of form you are filing. | |

| 1096 Box 7 | For this form, the sections stop at Box 6. There is no Form 1096 Box 7 or beyond. | |

Form 1096 Paper Filing Due Dates

The due dates for filing Form 1096 for the 2020 tax season are directly related to the other paper forms you’re filing.

- With Forms 1097, 1098, 1099, 3921, 3922, or W-2G, file by March 1, 2021.

- With Form 1099-NEC, file by February 1, 2021.

- With Form 5498, file by June 1, 2021.

Free Printable 1096 Form

There is not an online free printable Form 1096. The IRS requires that Form 1096 be scannable for ease of processing, so you must order Form 1096 from them ahead of time. The form is still free, but you’ll need to visit www.IRS.gov/orderforms to order the forms. It’ll take about 10 business days before you’ll receive them, so leave yourself plenty of time.

If you want to grab paper copies, we’ve got you covered.

Can You File Form 1096 Electronically?

If you’re only filing Form 1099s, you do not need to include a 1096 when filing electronically.

If you’re efiling any of the other forms 1096 usually accompanies (Forms 1097, 1098, 3921, 3922, 5498, and W-2G), you will need to use the IRS’s FIRE System.

Benefits of Filing Electronically

Now, after learning more about Form 1096, you may be thinking, “What?! ANOTHER FORM?” We hear you. Filing taxes as a business is an extremely taxing process, but in the case of Form 1096, this is one you can avoid by filing electronically.

The SSA encourages efiling as it offers a long list of benefits, including time savings and reduced risk of errors. Plus, due to the Taxpayer First Act, many businesses will be required to file electronically in the coming years. Businesses filing 250 or more forms are already required to efile. Businesses will need to efile if filing 100 or more forms for 2021 and 10 or more forms for 2022. So, it’s in your best interest to begin the transition to efiling as soon as possible.

Want to learn more about efiling? We worked with a Certified Public Accountant (CPA) to complete a guide on How to Efile Taxes.

Efiling Saves Time

Efiling saves both you and the IRS time. For you, there’s no printing forms, filling them out by hand, or going to the post office. For the IRS, there’s no need to transcribe each paper return into their own system. Efiling makes the process quicker for everyone.

In the case of Form 1096, you can’t just print out the form yourself. Form 1096 must be scannable by IRS processing systems, so they require you to order the form in advance. It’s free, but it can take 10 business days to arrive.

Efiling Makes It Easier Next Year

The best efiling software—ours included—stores your information, which means you only need to enter your information once. The following year, the software will autofill each of the relevant boxes, saving you the time it takes to re-enter all of that data.

Efiling Follows Government Compliance

On July 1, 2019, The Taxpayer First Act was signed into law. It aims to modernize the way Americans do taxes by simplifying and streamlining the process. The IRS is moving people and businesses towards efiling. By 2022, businesses filing just 10 or more forms must electronically file.

Efiling is the way of the future, so make the switch as soon as you can.

Efiling is Accurate and Secure

There’s a great deal more room for error with the paper method of filing your tax returns. When you make a mistake efiling, you’ll be able to see it right away as opposed to waiting for the IRS to receive the information by mail. And on the IRS’s side, their employees need to manually type each tax return into their system, leaving plenty of room for human error.

Efiling software also has built-in data verification and TIN verification, which prevents most of the common mistakes made when paper filing.

An encrypted network is much more secure and reliable than sending returns through the postal service. Efiling systems are encrypted under IRS guidelines using strong encryption programs along with safeguards to prevent information theft.

Efiling is Sustainable

Filing paper tax forms each year uses up a lot of paper. If you are trying to be a more environmentally conscious business, efiling is the way to go.

More From Blue Summit Supplies

💡 When to File 1099s and How to Do it

💡 All About Tax Form Mailing: 1099 and W2 Envelopes

💡 Your Guide to Different Forms of Income Tax Return

We’re big on helping businesses and individuals find the best tax filing options. Follow our blog for the latest trends, strategies, product comparisons, and more.

If you have any questions or want to talk to someone at Blue Summit Supplies, send us an email or connect with us on Twitter, Facebook, or Instagram.

For more informative articles about office supplies, subscribe to our email newsletter!

For more informative articles about office supplies, subscribe to our email newsletter!

Never fear, you won't begin receiving daily sales emails that belong in a spam folder. Instead, we promise a fun weekly roundup of our latest blog posts and great finds from across the web. And if you lose interest, it's always easy to unsubscribe with a single click.