The new year brings a series of new beginnings: new goals, new products, and a new perspective. And while it’s great to plan ahead, you also need to wrap up the previous year.

As a small business owner or a self-employed individual, filling out 1099 is a top priority.

With the January 31 deadline fast approaching, you must file 1099s with the IRS and mail the recipient copies to your contractors and freelancers.

The only catch? Filling out a 1099 tax form can be tricky, especially considering the rule changes in 2020.

This guide will answer all of your ‘How to fill out a 1099’ questions and help you stay in the IRS’s good books.

Understanding the Different Types of 1099s

First and foremost, you need to know the different types of 1099s. This will help you determine which form you should fill out depending on the type of income you earned in the previous year.

As of 2021, there are 20 different 1099 form variations. Let’s take a look at the most popular ones below:

1099-DIV

This form goes to taxpayers who have earned dividend income throughout the tax year. These dividends are usually in the form of cash and given as rewards to investors by corporations for owning the latter’s shares or stock.

1099-INT

This form is sent to taxpayers who have earned more than $10 worth of interest during the tax year and is usually sent out by banks, brokerage firms, and other investment firms.

1099-B

This form is sent by a broker to a taxpayer, listing all the different transactions related to the sale of stocks, securities, commodities, and other similar items. In addition, transactions executed through a barter exchange must also be reported on the 1099-B form.

1099-R

This form is issued if a taxpayer received a payout or distribution from a retirement plan, pension, or individual retirement account (IRA) in the tax year. Life insurance contracts and specific annuities can also issue a 1099-R.

That said, we recommend consulting a tax professional if you’re unsure about paying taxes on a distribution since not all retirement distributions are taxable under the law.

1099-S

This form is issued to taxpayers for real estate transactions—provided they’re successful in closing a deal or making an exchange during the tax year. Examples include the sale of land, industrial buildings, and residential properties.

Again, we recommend consulting a tax professional to determine whether or not a 1099-S is applicable in your financial situation. You may be exempt from a real estate transaction.

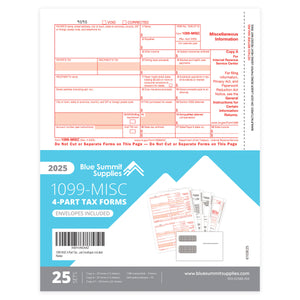

1099-MISC

This form is generally used for income that cannot be categorized under the abovementioned headings. Specific types of non-employment income, such as money won in a game show, are reported as a 1099-MISC.

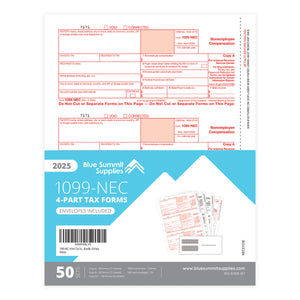

At the beginning of 2020, the IRS made a few significant changes to its reporting requirements for non-employee compensation. Now, businesses have to report specific types of non-income compensation on Form 1099-NEC. As per regulations, this form must be filed if a business pays a non-employee $600 or more in the tax year. Moreover, this non-employee can be an independent contractor or any other person hired on a contract basis to provide a service. Previously, the reporting was done in form 1099-MISC.

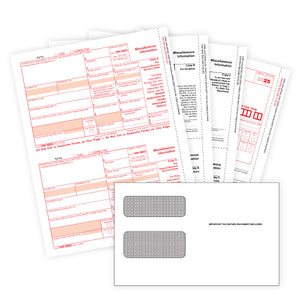

How to Fill Out 1099-MISC

Let’s tackle how to go about filling out this form. For starters, know that there are 18 boxes on the 1099-MISC. We will discuss how to file each box in more detail below.

Payer and Recipient Information Boxes

The person filling out 1099 is the payer. If this is you, you’ll need to put the following information on the relevant boxes:

- Your full name

- Your complete address

- Your tax identification number (TIN)

Blue Summit Supplies Top Tip: Ask your 1099 recipients to fill out a Form W-9 before you pay them. W-9s provide you with all the information you’ll need to ensure you have sent the 1099 form to the right place and on time at year’s end.

How to Fill Out 1099-MISC Forms, Box by Box

|

Box 1 – Rents |

Box 1 on Form 1099-MISC reports the amount you paid to the recipient for rent. Examples of applicable arrangements include rentals of office space, machinery, and land. |

|

Box 2 – Royalties |

Box 2 is for payments of royalties in the amount of $10 or more, such as for mineral rights or intangible property (copyrights, trade names, etc.). |

|

Box 3 – Other Income |

As is typical for IRS forms, the 1099-MISC includes a catch-all box for any other income in the amount of $600 or more that isn't reportable elsewhere on the form. Income items that may be reported in Box 3 include prizes and awards, a deceased employee’s wages, payments made to individuals in medical research studies, and damages paid as a result of a lawsuit. |

|

Box 4 - Federal Income Tax Withheld |

If the recipient hasn't given you their TIN, their earnings are subject to backup withholding. Backup withholding is a method the IRS uses to attempt to decrease instances of unreported income, as the withholding process for nonemployees is complicated and unfavorable for everyone involved. They would much rather you get the correct personal information from the recipient and report the amount they were paid, gross of any applicable taxes. That said, if you have recipients for whom you’ve withheld federal income tax, that amount should be reported in Box 4. |

|

Box 5 - Fishing Boat Proceeds |

Proceeds from the sale of a catch on a fishing boat with fewer than 10 crew members belong in Box 10. |

|

Box 6 - Medical and Health Care Payments |

Box 6 reports payments of $600 or more made by a business to a physician or other medical service provider. Payments to pharmacies for prescription drugs do not have to be reported. |

|

Box 7 - Payer Made Direct Sales Totaling $5,000 or More |

Box 7 is where you'll report direct sales revenue of $5000 or more made anywhere other than in a permanent retail establishment. Do not enter a dollar amount in this box. (Note: You may either report direct sales here, or in box 2 on form 1099-NEC.)

|

|

Box 8 - Substitute Payments in Lieu of Dividends or Interest |

Total payments made to a broker for a customer because of a loan on the customer’s securities are reported in Box 8. These payments are made as a substitute for dividends or tax-exempt interest that accrued while the securities were on loan. The minimum reportable amount for this box is $10. |

|

Box 9 - Crop Insurance Proceeds |

Insurance companies who pay $600 or more in insurance proceeds to farmers report this amount in Box 9. |

|

Box 10 - Gross Proceeds Paid to an Attorney |

Box 10 reports amounts of $600 or more paid to an attorney for legal services. |

|

Box 11 - Fish Purchased for Resale |

Report total cash payments of $600 or more to anyone who trades or catches fish (and all forms of aquatic life) as a business operation. |

|

Box 12 - Section 409A Deferrals |

Box 12 reports the total amount of at least $600 deferred for a non-employee under a non-qualified deferred compensation plan. |

|

Box 13 - FATCA Filing Requirement Checkbox |

Box 13 should be checked if you are a US payer who uses 1099 forms to fulfill a Chapter 4 account reporting requirement under the Foreign Account Tax Compliance Act (FATCA). |

|

Box 14 |

Not in use |

|

Box 15 - Nonqualified Deferred Compensation |

In box 15, report nonqualified deferred compensation (NQDC) that is currently taxable because the NQDC plan failed to meet the requirements of Section 409A of the Internal Revenue Code. |

|

Boxes 16-18 - State Information |

Payers using the Combined Federal/State Filing Program fill these boxes. These are not required to be completed for the IRS, and may be used for up to two states. |

Send Out the 1099s

The final step in our Form 1099 instructions is getting them out the door! Here are some great resources for how to file the forms you’ve just finished filling up:

If you're looking for more tax-related information, check out the Blue Summit Supplies blog.