If you make qualifying payments to nonemployees in 2020, you’ll need to file Form 1099-NEC in the 2021 tax season. This incoming form is replacing Form 1099-MISC for reporting nonemployee compensation.

Here’s everything you need to know about Form 1099-NEC—when to use it, how to fill it out, and filing deadlines—along with an update on how this form works alongside the 1099-MISC.

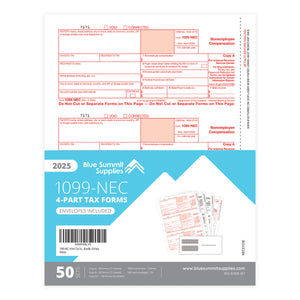

Need to grab some forms 1099-NEC? We got you covered. The

Quick Links:

- What is Form 1099-NEC?

- When to Use Form 1099-NEC

- What is Nonemployee Compensation?

- Deadlines for Filing Form 1099-NEC

- How to Fill Out Form 1099-NEC

- How to File Form 1099-NEC With the IRS

- Where to Download Form 1099-NEC

- Exceptions: Payments that Don’t Require Form 1099-NEC

- 1099-MISC vs 1099-NEC: Frequently Asked Questions'

Beginning with tax year 2020, nonemployee compensation will no longer be reported in Box 7 of the 1099-MISC form. Instead, all nonemployee compensation must now be reported on a separate Form 1099-NEC. If you pay an independent contractor nonemployee compensation, you must separate nonemployee compensation payments from all of your other Form 1099-MISC payments. Click here to learn more, or buy 1099-NEC forms here.

Beginning with tax year 2020, nonemployee compensation will no longer be reported in Box 7 of the 1099-MISC form. Instead, all nonemployee compensation must now be reported on a separate Form 1099-NEC. If you pay an independent contractor nonemployee compensation, you must separate nonemployee compensation payments from all of your other Form 1099-MISC payments. Click here to learn more, or buy 1099-NEC forms here.

What is Form 1099-NEC?

Starting in the 2020 tax year, Form 1099-NEC replaces Form 1099-MISC for reporting nonemployee compensation. Businesses will need to file Form 1099-NEC in the 2021 tax season to report nonemployee compensation paid during the 2020 tax year.

You do not need to use Form 1099-NEC in the 2020 tax season to report any nonemployee compensation payments your business made during 2019.

When to Use Form 1099-NEC

You’ll need to file Form 1099-NEC for each person to whom you have paid at least $600 in:

- Services performed by someone who is not your employee (including parts and materials)

- Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish

- Payments (not gross proceeds) to an attorney

The $600 threshold for these payments must be reached during the tax year.

You will also need to file Form 1099-NEC for anyone from whom you withheld federal income tax under backup withholding rules for any amount, even if it’s less than $600.

What is Nonemployee Compensation?

Just as the name suggests, nonemployee compensation is the payments your business makes to “nonemployees”.

However, according to IRS guidelines, you will need to use Form 1099-MISC to report nonemployee compensation if all of the following conditions apply:

- The compensation was paid to someone who is not your employee

- The compensation was paid for services in the course of your trade or business

- The compensation was paid to an individual, partnership, estate, or, in some cases, a corporation

- The payments made to that payee were at least $600 or more for the year

Here are some examples of nonemployee compensation which you may need to report on Form 1099-NEC:

- Payments for the services your business needs to keep operating

- Payment for any parts or materials used to perform those services, if the parts/materials were incidental to the service

- Any professional service fees your business made to accountants, architects, attorneys (including law firms established as corporations), etc.

- Fees paid by one professional to another (e.g. if you engaged in fee-splitting with someone else in your industry)

- Commissions paid to nonemployee salespersons that are subject to repayment but not repaid during the calendar year

For a full list of nonemployee compensation payments your business may need to report for the 2020 tax year, check the IRS’s Form 1099-NEC guidelines or ask your CPA to outline your obligations.

How to Fill Out the Parts of Form 1099-NEC

Here’s a step-by-step explanation for filling out each part of Form 1099-NEC.

| How to Fill Out Form 1099-NEC | ||

| Payer's Information | Fill out your business’s name, address, and taxpayer ID. | |

| Recipient's Information | Add the name, address, and taxpayer ID of the recipient who received nonemployee compensation from your business. | |

| Box 1 | For nonemployee compensation, if you paid this person $600 or more during the year. | |

| Box 4 | For any federal income tax withheld, though it’s not usual to withhold income taxes for nonemployee payments unless you have received a backup withholding order for that person. | |

| State Information | Does your state have an income tax? If so, make sure you include the total payment amount you paid the recipient for the year and any state tax you withheld. | |

If you are holding assets in foreign countries, you may also need to include a checkmark for the FATCA (Foreign Account Tax Compliance Act) filing requirement.

If you don’t have any of the required recipient’s information on hand (taxpayer ID, address, etc.), you can get it by using Form W-9. Don’t skip this step; you are obligated to have a Form W-9from each recipient before you fill out Form 1099-NEC.

How to File Form 1099-NEC With the IRS

You can file a paper copy of the form via mail, or file the form electronically using the IRS FIRE system. For efiling, you can also use our quick, easy efiling platform. It makes it simple to efile W2s and 1099s. Submit your tax information through our IRS-approved channels. Our service promises state-of-the-art security, digital record keeping, as well as full app integration with Excel and other accounting software.

Deadlines for Filing Form 1099-NEC

Here are the deadlines for filing Form 1099-NEC with the IRS and each nonemployee.

January 31 — Give Copy B of Form 1099-NEC to Nonemployees

You need to give Copy B of Form 1099-NEC to nonemployees by January 31 of the year after the reporting year.

In other words, if you make any qualifying payments to a nonemployee in 2020, you’ll need to give that nonemployee a Form 1099-NEC by January 31, 2021.

January 31 — File Copy A of Form 1099-NEC with the IRS

You also need to file Copy A of Form 1099-NEC with the IRS before February 1, 2021.

Where to Download Form 1099-NEC

You can download a copy of Form 1099-NEC on the IRS website here:

Exceptions: Payments that Don’t Require Form 1099-NEC

Some payments don’t need to be reported on Form 1099-NEC, even though they may still be taxable to the recipient.

Here’s an overview of common 1099-NEC exceptions. Make sure you aren’t reporting any of these payments on Form 1099-NEC.

Payments to a Corporation

Generally, payments to a corporation (including a limited liability company that is treated as a C or S corporation) don’t need to be reported on Form 1099-NEC.

Keep in mind, the following payments to corporations are reportable on Form 1099-NEC:

- Fish purchases for cash

- Attorney fees

- Payments by a federal executive agency for services (vendors)

Personal Payments

Remember: Form 1099-NEC is only for reporting when payments are made in the course of your trade or business. Personal payments are not reportable on this form.

Wages Paid to Employees

You need to use Form W-2 to report wage payments to employees. On that note, make sure you’re clear on whether a payee should be classified as an employee or nonemployee according to IRS regulation. Misclassifying employees and incorrect filing can result in penalties for your business.

Gross Proceeds to an Attorney

Attorney fees are reported on Form 1099-NEC. But any gross proceeds (i.e. not fees) you pay to an attorney are reported on the revised 2020 1099-MISC form. Do not report gross proceeds to an attorney on Form 1099-NEC.

Other Common 1099-NEC Exceptions

- Payments for merchandise, telegrams, phone, freight, storage, or similar items

- Payments of rent to real estate agents or property managers (use Form 1099-MISC)

- Payments to a tax-exempt organization, including tax-exempt trusts; federal, state, and local governments; or a foreign government

1099-MISC vs 1099-NEC: Frequently Asked Questions

Here are some quick answers to common questions related to using (and filing) Form 1099-MISC alongside Form 1099-NEC.

Why Did the IRS Introduce Form 1099-NEC?

While it may sound like a brand new form, the 1099-NEC is and old form that hasn’t been used since 1982. The IRS has revived the 1099-NEC to split out how nonemployee compensation and miscellaneous income are reported and filed.

This means that starting with the 2020 tax year, you will use:

- Form 1099-NEC to report nonemployee compensation

- Form 1099-MISC to report miscellaneous income

How is Form 1099-MISC different in 2020?

If the 1099-MISC looks a little different to you in 2020, there’s no need to have your reading glasses checked. Because Form 1099-NEC now handles nonemployee compensation reporting, the IRS has revised Form 1099-MISC for the 2020 tax year.

Here are the changes in the revised Form 1099-MISC, according to the latest IRS guidelines:

- Payer made direct sales of $5,000 or more (checkbox) in box 7

- Crop insurance proceeds are reported in box 9

- Gross proceeds to an attorney are reported in box 10

- Section 409A deferrals are reported in box 12

- Nonqualified deferred compensation income is reported in box 14

- Boxes 15, 16, and 17 report state taxes withheld, state identification number, and amount of income earned in the state, respectively

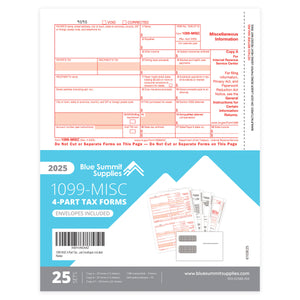

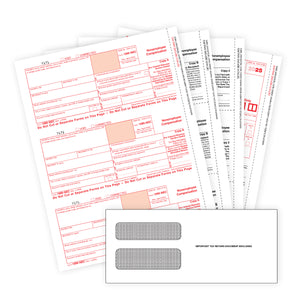

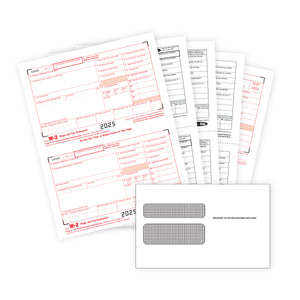

Blue Summit Supplies carries all of the preprinted tax documents you need to file W2s and 1099s. Stock up early to make tax season as smooth and stress-free as possible.

When in doubt, ask your CPA for help

Filing Form 1099-NEC is a straightforward process. But it pays to remember that every business’s tax obligations are different.

If you’re unsure of your business’s filing obligations when it comes to Form 1099-NEC, ask your CPA or a qualified tax professional to guide you through the process. If you misunderstand your obligations and make a mistake during the filing process, you may end up with penalties that could have been easily avoided.

For more informative articles about office supplies, subscribe to our email newsletter!

For more informative articles about office supplies, subscribe to our email newsletter!

Never fear, you won't begin receiving daily sales emails that belong in a spam folder. Instead, we promise a fun weekly roundup of our latest blog posts and great finds from across the web. And if you lose interest, it's always easy to unsubscribe with a single click.