Providing 1099 forms to your contractors is just as important as giving W-2s to your employees.

You’re responsible for filing the 1099 form with the IRS, as well as providing a copy to your contractors and freelancers. You mess it up, and you’ll get a penalty from the IRS.

Don’t worry—we’ve got you.

In this guide, we’ll discuss when to file 1099s, what happens when you don’t file the forms on time, and how to fill 1099 right with the IRS.

We’ve got a lot of ground to cover, so let’s get to it!

What is an IRS 1099 Tax Form?

An IRS 1099 tax form is a record confirming you paid $600 or more to your contractors or individual vendors during the tax year. From the receiver’s perspective, these forms are a collection of forms to record they received money from a person or entity that wasn’t their employer.

The person giving the money will fill out the 1099 form and send copies to their contractors and the IRS. The idea behind 1099s is to clarify how much income you paid to your non-employees during the year and what kind of expense it was. You’re responsible to report those expenses in different places on your tax returns based on their nature.

After receiving Form 1099, your contractors will calculate their own taxes because businesses generally don’t withhold their taxes for them.

That’s one of the main differences between W-2s and 1099s. If you want to learn more about the W-2 form, you can check out this article.

When Should You File Form 1099

You must file Form 1099–both Copy A and Copy B– with the IRS and the respective independent contractors by January 31 of the following year. This stands regardless of whether you submit the forms through the mail or e-file them.

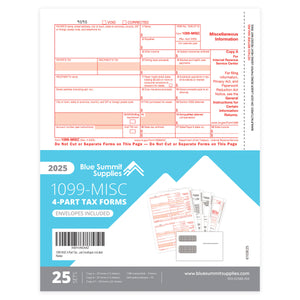

The payer is likely to issue Form 1099-MISC or 1099-NEC, depending on the agreement or contract, to each individual or an incorporated business who has received at least the following payment or income amounts (this may not be a complete list):

- $600 or more in business rental income

- $600 or more in services performed by a person of business who isn’t an employee

- $600 or more in prizes, awards, or other income payments

- At least $10 of royalty income

- Business attorney fees that are either $600 or more, regardless of the attorney's incorporation status

- At least $400 for independent contract work

- At least $5000 of direct sales to a buyer who isn’t a permanent established retailer for resale

Penalties for Late Filing

The penalties for late filing are listed on the IRS website by year.

The penalty you get depends on how late the IRS receives the 1099 and if they believe there was intentional disregard. Penalties are issued for each return or statement, so the more contractors you work with, the higher your penalty.

In addition, penalties for filing incorrect information are different from the penalty for filing a late statement.

For small businesses with gross receipts totaling $5 million or less, the late penalties on 1099s are as follows for forms due in 2026.

Charges for Each Information Return of Payee Statement

|

Up to 30 Days Late |

31 Days Late Through August 1 |

After August 1 or Not Filed |

Intentional Disregard |

|

$60 |

$130 |

$340 |

$680 |

Note: Penalties may increase for any given year subject to inflation adjustments.

How to File Form 1099 With the IRS

You can file 1099s with the IRS in different ways: file with paper or file electronically (known as e-filing).

-

Paper filing is a tried-and-tested method where 1099s are printed, filled out on the computer or by hand, sealed, and mailed to the IRS using IRS-approved paper and envelopes.

The only problem? It can take weeks before the 1099s reach the IRS. This means if there are any mistakes with the 1099s, it'll take a while to find out and even more time to correct the mistakes. Plus, IRS employees will need to manually transcribe each 1099 into the IRS system.

-

E-filing is more efficient, where everything is done online. Once the forms are completed, they are sent directly to the IRS, which also means mistakes are found immediately. If there are no mistakes, the 1099s can be inputted into the system directly without having to be transcribed by IRS staff, which leaves far less room for human error.

The added efficiency and reliability of e-filing is enforced within the Taxpayer First Act of 2019.

The Taxpayer First Act mandates that more businesses begin to file their taxes electronically. This is to simplify and modernize the way Americans and American businesses do taxes. In 2021, taxpayers filing 100 or more tax returns had to e-file, which is further reduced to 10 in 2022 and beyond.

How to File Form 1099

To file Form 1099, you'll need:

Fill this information out on Copy A and Copy B of Form 1099. When that's done, send Copy A to the IRS, and Copy B to the contractor.

When mailing such sensitive documents, be sure you send them in proper security envelopes to maintain the recipient’s privacy. These are special envelopes with transparent plastic windows that reveal the name and address of the recipient but protect the rest of the contents from getting exposed.

There are also envelopes specifically designed to transport W-2s. While some W-2 envelopes will work for Form 1099s, some won't. Therefore, it's better to use 1099 envelopes that are specially designed for the Form 1099s you are mailing.

What's more, the size, dimensions, and placement of the security window(s) are determined by the kind of software you're using and the varying sizes of the different tax forms. Sometimes, you'll need envelopes that have been specifically designed to hold the different types of 1099s.

For more details, read our article: All About Tax Form Mailing: 1099 and W-2 Envelopes.

If you want to avoid envelope headaches, make the switch to e-filing!

How to E-file Form 1099

You'll need the same information to e-file Form 1099 as you would when filing with paper, but the former process is just smoother and more efficient. And oh! You don't have to spend time worrying about not getting the right kind of envelopes.

Before you begin the e-filing process, ensure you have all of the relevant information on hand. If you e-filed your tax forms the previous year, you may already have all the information stored, saving you some precious time and effort. However, you'll have to check with your e-file provider to confirm this.

Alternatively, you can use a W-9 to gather relevant information from all your independent contractors.

To e-file a Form 1099, you'll need:

- The legal name of the independent contractor

- The business name (if different from the Contractor name).

- The entity classification (C Corp, S Corp, Partnership, Trust, or disregarded entity)

- The contractor’s Tax Identification Number (TIN) and type (FEIN or SSN)

- The address of the independent contractor

Want step-by-step instructions? Check out this helpful guide to find out how to fill out 1099-MISC forms.