When sending important documents by mail, such as tax information, security envelopes must be used to maintain the secrecy of the recipient. 1099 and W2 envelopes are used for sending 1099 and W2 tax forms by mail, but between size, window placement, and the type of form you have, there’s plenty to go wrong in the office supplies department.

In this post, we’ll answer your burning questions about tax envelopes, including what’s the difference between 1099 and W2 tax forms, do W2s have to be mailed in special envelopes, and where can you buy tax form envelopes.

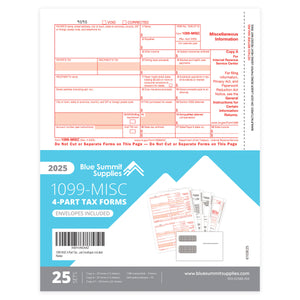

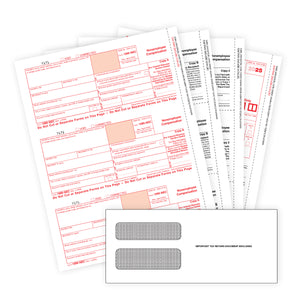

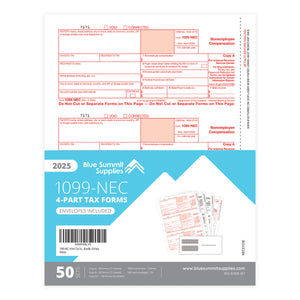

Beginning with tax year 2020, nonemployee compensation will no longer be reported in Box 7 of the 1099-MISC form. Instead, all nonemployee compensation must now be reported on a separate Form 1099-NEC. If you pay an independent contractor nonemployee compensation, you must separate nonemployee compensation payments from all of your other Form 1099-MISC payments. Click here to learn more, or buy 1099-NEC forms here.

Beginning with tax year 2020, nonemployee compensation will no longer be reported in Box 7 of the 1099-MISC form. Instead, all nonemployee compensation must now be reported on a separate Form 1099-NEC. If you pay an independent contractor nonemployee compensation, you must separate nonemployee compensation payments from all of your other Form 1099-MISC payments. Click here to learn more, or buy 1099-NEC forms here.

What is a W2 Tax Form?

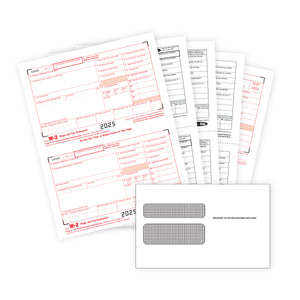

Every January, employees will receive an IRS W2 tax form from their employer. The IRS requires employers to record an employee’s tax, wage, and salary information and report it to them on a W2.

A W2 tax form shows the amount of money an employer paid an employee over the course of the year, as well as the amount of taxes withheld from the employee’s paycheck for the year. It is required to file federal and state taxes.

What is a 1099 Tax Form?

A 1099 is similar to a W2 tax form, with a few key differences. One such difference is that a W2 is received by an employee from their employer, whereas a 1099 is received by a contract worker or freelancer from their client.

If you’re an independent contractor, freelancer, or own your own business, it’s likely you’ll receive numerous 1099s depending on how many clients you had over the course of the year. The IRS requires businesses to issue a form 1099 if they have paid a contractor at least $600 during the tax year.

There are several different kinds of 1099 tax forms—16 different kinds, in fact.

Another important difference between the 1099 and the W2 is that businesses often do not withhold taxes for you; therefore, the 1099 will only report your income. As an independent contractor, you are responsible for figuring out how much you owe in taxes, and for paying the self-employment tax.

Starting in the 2020 tax year, Form 1099-NEC replaces Form 1099-MISC for reporting nonemployee compensation. Businesses will need to file Form 1099-NEC in the 2021 tax season to report nonemployee compensation paid during the 2020 tax year.

What to Look For in 1099 or W2 Envelopes

Are 1099 and W2 Envelopes the Same?

There are many different types of both W2 and 1099 envelopes. The dimensions, size, and placement of the security window(s) depend on the software you are using as well as the alternating size of the different tax forms the envelope will hold. Some W2 envelopes will work with some 1099 tax forms, but some will not. And certain types of 1099 forms need a specific type of envelope.

Window Placement

The window placement on any security envelope is very important. If the measurements are off, it could mean displaying private information, or not being able to see the address at all. The window on a security envelope must be exactly where you need it, especially when sending private and important documents like W2s and 1099s.

Size

The size of your document will determine the size of your envelope. In order to maintain your desired window placements, you need to ensure your envelope is the right size. If it’s too small, you won’t be able to fit your tax documents inside without adding unprofessional folds. If it’s too large, you risk the document moving around inside the envelope, which could throw off the window placement, either revealing too much or too little.

Security

When sending private documents, you need to make sure there’s added security so that no one can read what’s inside. You need to make sure your envelope does not have a plain white interior because this could breach the 1974Privacy Act. Any business transactions between your company and your customer or employer should be kept between you and them.

A pattern lining the inside of the envelope can prevent anyone from looking at what’s inside. Even when held up to a light, a security envelope will block what’s inside. These security patterns come in all sorts of fun shapes, including confetti, linen, burlap, and crosshatch. You can even have a custom security tint designed in your own branding.

Cost

Depending on the size of your business, the cost of tax form envelopes may or may not be a consideration. If you only need to send a few W2s each year, the cost won’t affect your bottom line much at all. On the other hand, large businesses that need to send out hundreds of W2s each year will need to consider cost and bulk pricing. Never reduce quality to the point of downgrading window placement, size, and security. When you send a tax form, it needs to be secure and private, and that may mean a higher-costing envelope.

Common Tax Form Envelopes

Standard Half-Sheet W2 Form Envelopes

Half-sheet W2 form envelopes are the most common envelope size for W2s. It’s an envelope with a double-window design so that both the recipient and return addresses are clearly visible. They can sometimes work for 1099s, but that’s not always the case. The half-sheet W2 tax form envelope fits computer-printed W2 forms from QuickBooks or similar accounting software.

4-Up W2 Tax Form Envelopes

The 4-up W2 tax form envelope also fits a computer-printed 4-up W2 form from QuickBooks or similar accounting software. It’s an envelope with a double-window design, but the layout is much different than a half-sheet W2 envelope. Mixing these up will prevent the addresses from showing correctly.

4-up envelopes will not work for standard half-sheet W2 forms or 1099 forms.

Window Envelopes For QuickBooks

Standard half-sheet W2 form envelopes should work for QuickBooks printed W2 tax forms. For other QuickBooks mail, you will need different envelopes. QuickBooks checks and invoices require a specific custom #8 envelope size that’s slightly wider than a standard #8 envelope.

Learn more about QuickBooks envelope dimensions in our article: What are the best envelopes for QuickBooks checks and invoices?

Where To Buy W2 Envelopes

Both W2 and 1099 envelopes can be purchased online, at local office supply stores, and at some big box stores. When ordering envelopes online, be careful to order the exact size you need for the corresponding tax documents.

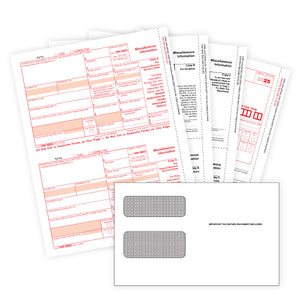

Are you wondering: “where can I buy 1099 envelopes and W2 envelopes?” Blue Summit carries standard half-sheet W2 envelopesas well as 4-up W2 tax form envelopes.

And we have a 100% money back guarantee!

Make sure you have the exact right envelopes by purchasing our W2 6 Part Tax Forms Kit. It contains all of the documents you need to file your employee W2s. The kit includes W2 Copy A Forms, W2 Copy B Forms, W2 Copy C/2 Forms, W2 Copy D/1 Forms, W3 Transmittal forms, and the corresponding number of self seal envelopes.

More From Blue Summit Supplies

💡 Security envelopes are a more official form of mail, used to contain sensitive information such as bills, credit cards, banking info, or paychecks. With these being the most common materials found in security envelopes (also known as windowed envelopes), the security requirements are much higher than those of regular envelopes. Learn more in our article: What Is A Security Envelope?

💡 Receipts are essential for personal and professional records, but where do you store them all? Implementing an organizational method can help you prevent any accidental loss or missing proof of expenses. Learn how to organize, create, and keep track of your receipts with our guide on How to Organize Receipts.

Do you love envelopes and office organization as much as we do? Follow our office supplies blog for the latest trends, strategies, and more.

If you have any questions or want to talk to someone about office supplies, send us an emailor connect with us on Twitter,Facebook, or Instagram.

This article is designed to provide accurate and authoritative information. However, it is not a substitute for legal advice and does not provide legal opinions on any specific facts or services. The information is provided with the understanding that any person or entity involved in creating, producing or distributing this article is not liable for any damages arising out of the use or inability to use this product. You are urged to consult an attorney concerning your particular situation and any specific questions or concerns you may have.

For more informative articles about office supplies, subscribe to our email newsletter!

For more informative articles about office supplies, subscribe to our email newsletter!

Never fear, you won't begin receiving daily sales emails that belong in a spam folder. Instead, we promise a fun weekly roundup of our latest blog posts and great finds from across the web. And if you lose interest, it's always easy to unsubscribe with a single click.