Different states have different requirements for filing 1099s, and these differing laws can get confusing. Reference our designated landing page on 1099 state-specific requirements for a definitive guide on how to file your 1099s according to the state in which you’re filing.

Visit the landing page here.

This information was pulled from several sources including Payable, the IRS, and individual state department sites.

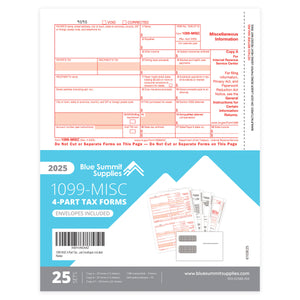

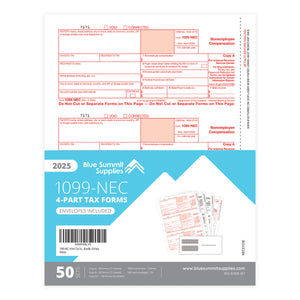

Beginning with tax year 2020, nonemployee compensation will no longer be reported in Box 7 of the 1099-MISC form. Instead, all nonemployee compensation must now be reported on a separate Form 1099-NEC. If you pay an independent contractor nonemployee compensation, you must separate nonemployee compensation payments from all of your other Form 1099-MISC payments. Click here to learn more, or buy 1099-NEC forms here.

Beginning with tax year 2020, nonemployee compensation will no longer be reported in Box 7 of the 1099-MISC form. Instead, all nonemployee compensation must now be reported on a separate Form 1099-NEC. If you pay an independent contractor nonemployee compensation, you must separate nonemployee compensation payments from all of your other Form 1099-MISC payments. Click here to learn more, or buy 1099-NEC forms here.