Efiling tax forms is becoming more and more popular thanks to its simplicity as well as the increasing demand from the government for efiled forms. There are many benefits to efiling for both the IRS and the individuals or businesses doing the filing. In this post, we’ll explain how to efile W2s and outline the benefits of efiling.

If you’re an employer efiling 1099s to independent contractors or freelancers, check out this article instead: How to Efile 1099s.

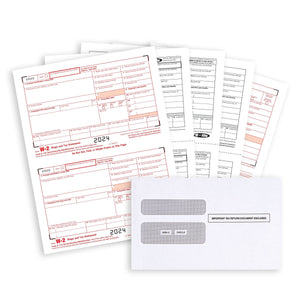

W2 Tax Forms

If you’re an employer with steady employees, you are required to file a W2 for each of your employees. As per IRS requirements, employers must record an employee’s tax, wage, and salary information to be reported on a W2 form each year.

Employers must send an IRS W2 tax form to each of their employees no later than January 31st of the following tax year. It is a requirement for filing federal and state taxes. The W2 differs from the 1099 in one critical way: as an employer, you withhold your employees taxes for them. The W2 form contains how much money an employee made in a tax year and the taxes withheld from the employee’s pay in that year. The W2 serves the purpose of reporting to the IRS how much you paid your employees as well as how much was withheld in taxes

The SSA encourages all employers to efile, as efiling saves time, effort, and reduces the risk of errors. If your business needs to file 250 or more W2 or W2c forms, you are required to efile. Any failure to do so may result in a penalty. This number is set to decrease each year—100 forms for 2021 and 10 forms for 2022. It’s in your best interest to begin the efiling process as soon as possible.

How to Efile W2s

To efile W2s, you need all of the same things you would need to file via the paper route. Before you begin the efiling process, make sure you have all relevant information on hand. Did you efile the previous year? If so, check with your efile provider to see if the relevant information is still stored in the software. This will save you from having to re-enter the data.

Important Info You Need to File Your Forms

For each employee you send a W2, you must include this information about your business:

- Your Employer ID Number

- Your Business Name

- Your Business’s State Tax ID Number

- Your Business Address

You must also include the following up-to-date information about your employee:

- Tax Identification Number or Social Security Number

- Name

- Address

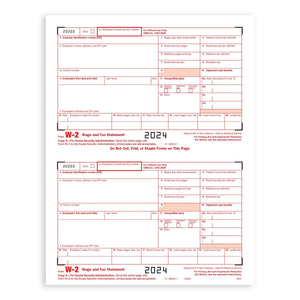

Use this helpful guide to learn what information to fill in on your W2.

| How to Fill Out W2 Forms, Box by Box | ||

| Box 1 | Wages, tips, and other compensation: Show total employee compensation for the calendar year. However, do not include elective deferrals (such as employee contributions to a section 401(k) or 403(b) plan) except section 501(c) (18) contributions. See IRS W2 instructions for more details. | |

| Box 2 | Federal income tax withheld: Show the total federal income tax withheld from the employee's wages for the year. Include the 20% excise tax withheld on excess parachute payments. | |

| Box 3 | Social security wages: Show the total wages paid (before payroll deductions) subject to employee social security tax but not including social security tips and allocated tips. | |

| Box 4 | Social security tax withheld: Show the total employee social security tax (not your share) withheld, including social security tax on tips. For 2019, the amount should not exceed $8,239.80 ($132,900 × 6.2%). | |

| Box 5 | Medical wages and tips: The wages and tips subject to Medicare tax are the same as those subject to social security tax (boxes 3 and 7) except that there is no wage base limit for Medicare tax. Enter the total Medicare wages and tips in box 5. | |

| Box 6 | Medical and health care payments: Enter payments of $600 or more made in the course of your trade or business to each physician, other supplier, or provider of medical or health care services. Include payments made by medical and health care insurers under health, accident, and sickness insurance programs. | |

| Box 7 |

Social security tips: Show the tips the employee reported to you even if you did not have enough employee funds to collect the social security tax for the tips. The total of boxes 3 and 7 should not be more than $132,900 (the maximum social security wage base for 2019). |

|

| Box 8 | Allocated tips: If you operate a large food or beverage establishment, show the tips allocated to the employee. | |

| Box 9 | Payer made direct sales of $5,000 or more: Enter an “X” in the checkbox for sales by you of $5,000 or more of consumer products to a person on a buy–sell, deposit–commission, or other commission basis for resale anywhere other than in a permanent retail establishment. Do not enter a dollar amount in this box. | |

| Box 10 | Dependent care benefits: Show the total dependent care benefits under a dependent care assistance program (section 129) paid or incurred by you for your employee. | |

| Box 11 | Non Qualified Plans: The purpose of box 11 is for the SSA to determine if any part of the amount reported in box 1 or boxes 3 and/or 5 was earned in a prior year. See IRS W2 instructions for more details. | |

| Box 12 | Codes: Complete and code this box for all items described in IRS W2 instructions guide. | |

| Box 13 | Checkboxes: Check all boxes that apply. If further details are required, see IRS W2 instruction guide. | |

| Box 14 | Other: If you included 100% of a vehicle's annual lease value in the employee's income, it also must be reported here or on a separate statement to your employee. You also may use this box for any other information you want to give to your employee. See IRS W2 instruction guide for further details. | |

| Box 15-20 | State and local income tax information: Use these boxes to report state and local income tax information. | |

GENERAL PRECAUTIONS: Remember to report payments in current boxes as the IRS uses this info to verify recipient tax returns.

For some helpful hints about efiling W2s and W3s, check out these frequently asked questions answered directly by the Social Security Administration.

Where to Efile W2s

To efile your W2s, you have a few options. Here are some simple choices for business owners.

Blue Summit Supplies Efiling Software

Our quick, easy efiling platform makes it simple to efile W2s and 1099s. Submit your tax information through our IRS-approved channels. Our service promises state-of-the-art security, digital record keeping, as well as full app integration with Excel and other accounting software.

Commercial Software

Choosing a commercial tax preparation software like Quickbooksis an option for efiling your taxes. These services will submit your tax information through electronic IRS-approved channels.

SSA Business Services Online Software

“The Business Services Online Suite of Servicesallows organizations, businesses, individuals, employers, attorneys, non-attorneys representing Social Security claimants, and third parties to exchange information with Social Security securely over the Internet.”

💡 Learn more about How to Efile Taxes from Certified Public Accountant Amy Northard from Accountant for Creatives®.

The Benefits of EFiling

Easier Next Year

Since most efiling software, ours included, stores your information, efiling sets you up for future success. The next time you need to efile, the software will fill in each of the relevant boxes automatically, saving you the time it would take to re-enter the data.

Compliance

The Taxpayer First Act was signed into law on July 1, 2019. It aims to modernize the way Americans do taxes in order to simplify and streamline the process. Efiling is cheaper and easier for the IRS, so it’s no wonder they require more and more businesses to file this way. In the coming years, the IRS will move people and businesses towards efiling. By 2022, businesses filing just 10 or more forms must electronically file.

Don’t wait until mandatory requirements kick in. Make the switch as soon as you can because it’s likely you will need to anyway in the near future.

Time Savings

With efiling, there’s no printing forms, filling them out by hand, or going to the post office. Efiling saves both you and the IRS time. The IRS doesn’t need to waste time transcribing returns into their system when you use an efiling method.

Accuracy

There’s much more room for error with the paper method of filing your tax returns. The IRS needs to manually type each tax return into their system, which leaves room for human errors. Efiling removes the possibility of human error on the IRS side. On your side, if you make a mistake, you’ll be able to see it right away instead of waiting for them to receive the information by mail.

Efiling software has built-in data verification and TIN verification that prevents most of the common mistakes made when paper filing.

Security

Compared to sending returns through the postal service, an encrypted network is much more secure and reliable. Efiling systems are encrypted under strict IRS guidelines. They use the strongest encryption program available along with other safeguards to prevent theft of your information.

Reduce Paper

This benefit may not be important to everyone, but for those who are trying to be more environmentally conscious, efiling reduces paper waste on forms and envelopes.

Did you know... Blue Summit Supplies offers quick and easy online filing for 1099, W2, and ACA forms? Create an account for free to get started! It’s a simple and safe way to electronically file, print, and mail your essential tax reporting forms.

More From Blue Summit Supplies

💡 If you’re still going the paper route, you’ll want to learn All About Tax Form Mailing: 1099 and W2 Envelopes, including the difference between 1099 and W2 envelopes and where you can purchase tax envelopes.

💡 Learn how to organize, create, and keep track of your receipts with our guide on How to Organize Receipts.

We’re big on efiling and helping businesses and individuals find the best tax filing options. Follow our blog for the latest trends, strategies, product comparisons, and more.

If you have any questions or want to talk to someone at Blue Summit Supplies, send us an email or connect with us on Twitter, Facebook, or Instagram.

This article is designed to provide accurate and authoritative information. However, it is not a substitute for legal advice and does not provide legal opinions on any specific facts or services. The information is provided with the understanding that any person or entity involved in creating, producing or distributing this article is not liable for any damages arising out of the use or inability to use this product. You are urged to consult an attorney concerning your particular situation and any specific questions or concerns you may have.

For more informative articles about office supplies, subscribe to our email newsletter!

For more informative articles about office supplies, subscribe to our email newsletter!

Never fear, you won't begin receiving daily sales emails that belong in a spam folder. Instead, we promise a fun weekly roundup of our latest blog posts and great finds from across the web. And if you lose interest, it's always easy to unsubscribe with a single click.