If you want to flourish financially, creating a household budget is a must. By keeping track of what you spend each month, you’ll know whether or not it’s necessary to adjust your spending and saving habits.

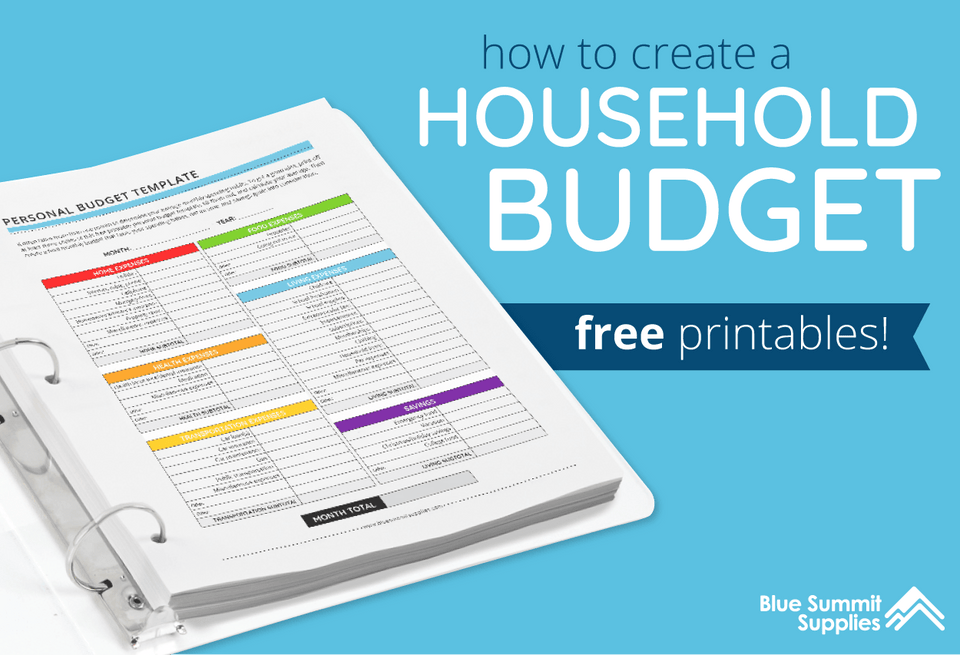

In this guide, we’re going over each step of how to create a household budget. We’ve also provided printable budget worksheets to help you stay organized along the way.

Step 1: Identify Your Net Income

To identify your net income, you need to determine what you’re taking home after taxes and any other deductions such as your 401(k) contributions. What’s left over is the money you’re able to spend and budget with.

To do this, subtract all your deductions from your income. The remaining number is your net income.

Step 2: Track Your Spending

This is the most fun part of making a budget (because making a budget is so fun, right?) because you get to see exactly where all your hard-earned cash is going. When doing this, it’s best to use a printable budget worksheet such as this one to stay organized.

Regardless of what medium you use to budget, it’s important to divide down your expenses into categories such as home, food, health, transportation, personal/family, and other. Then, determine which of these expenses are ‘fixed’, ‘regular that varies’, or ‘irregular.’

Fixed expenses: These expenses are the same every month. Things like fixed bills, subscriptions, loans, and gym memberships fall into this category. Fixed expenses can usually be put on autopay for convenience and peace of mind.

Regular expenses that vary: These expenses are regular and expected but with totals that vary every month. Examples include gas, groceries, and less predictable bills, like power or water.

Irregular expenses: These are less structured expenses, typically for leisure. They may include clothes shopping, going to events, or holiday and birthday presents.

After you have recorded all of your spending, add up everything from each category. This will provide insight into your current spending habits.

Step 3: Subtract Your Expenses from Your Net Income

After you add up your expenses for the year, subtract them from your yearly net income. The difference between these two figures is what you have to save or reallot.

If this number is too small for your comfort, you’ll need to reduce your spending habits. Since you now know where your money is going, you’ll be able to better see where you should cut back and where you can stay relaxed. Allocate a hard spending limit for each spending category and adhere to it. If you go over, penalize yourself by cutting back the month after or spending less in a different category to offset the difference.

Be Prepared – Save!

Setting aside savings in a specified fund is a hallmark of responsible money management. Much as we wish we could, no one can see the future. You never know what emergency might impact your finances and when. Mitigate the stress of a potential disruption to your cash flow by keeping a separate savings account with at least 3 months’ living expenses in liquid, easily accessible cash.

Setting aside savings in a specified fund is a hallmark of responsible money management. Much as we wish we could, no one can see the future. You never know what emergency might impact your finances and when. Mitigate the stress of a potential disruption to your cash flow by keeping a separate savings account with at least 3 months’ living expenses in liquid, easily accessible cash.

Step 4: Set Your Financial Goals

Consider your financial goals. What are you working toward? An early retirement? A stable home life? Maybe your sights are set on certain luxuries. Whatever your financial priorities may be, write them down (you can use our financial goals worksheet), and devise a plan to achieve these goals.

Determine how much you should be saving. How much do you want to have saved in five years? What about in 10 years? What about when it’s time to retire? By thinking about and planning your finances ahead of time, you’re more likely to achieve these goals.

Step 5: Adjust Your Spending and Saving Habits Accordingly

If you’re comfortable with your current spending and saving habits, your way forward is simple: structure your current budget, be aware of your goals and expenses, and continue what you’ve been doing.

However, if you’re falling short each month or anticipating large expenses, it’s time to make some spending and saving changes.

One way to save money is cutting back on your irregular expenses, things like eating out or shopping. If you already live a financially lean life, there are more serious programs to help dig out of debt or build up savings – our favorites are those created by Dave Ramsey.

When people start to make more money, they often adjust inflate their lifestyle accordingly. This means they’re never really saving money or eradicating debt.

By keeping your lifestyle in a lower economic bracket than your paycheck, you’ll be able to save money. For example, if you get a raise, continue budgeting and living as if you’d never gotten the raise and put the extra income away towards savings, or apply it to outstanding debt. This will reduce stress and pay off in dividends in the long run.

Step 6: Make Other Necessary Life Changes

Depending on your financial situation, it may be prudent to look for additional income by picking up more hours at work or by finding a side gig. Luckily, side gigs like freelance writing, photography, dog walking, house sitting, and rideshare driving are becoming more popular than ever.

Check out websites such as We Work Remotely or FlexJobs if you’re interested in working an additional job from home. Or consider creating a profile on Rover if you’re an animal lover in need of some extra, easy cash.

Step 7: Keep an Eye on Your Budget

You’ve sat down and made your budget, but you aren’t done! Now’s the hard part: sticking to it. Keep an eye on your finances. Checking your accounts doesn’t have to become a daily ritual, but it should become a regular habit, especially if you have big expenses. Make sure to record your spending each month, too; there are several apps that can help with this, like Mint and YNAB. Then, compare your spending habits from month to month and be aware of what habits are working and what changes need making.

Keeping a budget isn’t always easy, but by regularly evaluating your spending, you’re more likely to stick to it. Keep track of all your receipts, bills, and banking and credit card statements. When you stay on top of your finances, nothing will come as a surprise and you can rest easy knowing they’re in order.

How to Create a Household Budgeting Binder

When going over your finances and creating a budget, it’s best to keep all your materials in one place to stay organized. We suggest creating a budgeting binder. We’ve designed a series of free budget templates you can use in your binder to make the process a simple one.

|

Click here to download our free Household Budget Printables! |

After printing out our free printable budget worksheets, sort them in the following order:

- Budget Planner Cover

- Net Income Calculator

- Personal Budget Template

- Financial Goals Worksheet

- Bills Paid Checklist

- Outstanding Debt Worksheet

- Holiday Spending Worksheet

If you want your pages to be protected, slide them into sheet protectors that already have holes punched along the side.

Keep track of items like receipts, bills, and bank statements in sheet protectors or binder pockets, so you always have them handy. Also, with binder pockets that have a Velcro closure like these, you never need to worry about your important documents falling out and getting lost.

After gathering all your budget binder printables and other documents, it’s time to choose a binder. If you have a lot of documents, a larger binder like this one will suit you well. It has three clear exterior pockets so you can customize and label your binder. Our binders are built to last so you can continue to use them for years to come.

How do you budget? Let us know! Leave a comment below or find us on Twitter,Facebook, and Instagram. And, as always, if you have a question or concern, send us an email– Larry loves to hear from you!

For more informative articles about office supplies, subscribe to our email newsletter!

For more informative articles about office supplies, subscribe to our email newsletter!

Never fear, you won't begin receiving daily sales emails that belong in a spam folder. Instead, we promise a fun weekly roundup of our latest blog posts and great finds from across the web. And if you lose interest, it's always easy to unsubscribe with a single click.